| Post By Brigitte Blom Ramsey |

There is no doubt, legislators are facing difficult budget choices as the 2018 session nears its end. Proposals on the table to-date risk severely compromising our ability to ensure excellence with equity, to ensure each and every student learns at high levels, having an opportunity to realize their unique potential – regardless of their background.

Underfunded pension liabilities coupled with insufficient tax revenues have resulted in a crisis that must lead to revenue-producing tax reform critical for investments in the resource that matters most to our future growth as a state - our human capital.

Threats to equity across the pipeline of education include:

• K-12 Basic Funding: If our main SEEK funding for education doesn’t keep up with inflation, we naturally erode the investment that goes to the classroom and that supports student learning. This erosion disproportionately impacts students from low-wealth communities and low-income households where there are fewer resources to fill the gaps, fewer educational supports, and fewer community-based learning experiences.

• Postsecondary Institution Funding: Our disinvestment in public universities and KCTCS has resulted in cost shifting to the backs of students and families at a time when a college education is evermore important for future success. We are crowding out students who are most challenged to attend because of the cost of tuition and the wages foregone in the years when they invest their time in higher levels of education.

• Student Supports: Students don’t learn in a vacuum. Just like adults, they bring the cares of their world with them to life in school. As adults, we know this and we’ve put community-in-school investments in place to intervene and to mitigate the effects of harsh and sometimes toxic life experiences. Over the last decade, we’ve cut important parts of that support system, and we’ve allowed inflation to weaken them even further. Weakening preschool would add to that damage. Eliminating instructional materials and making further cuts to tutoring, (ESS), reading and math grants, and other major programs would be a move in the wrong direction.

• Teacher Supports: Dedicated programs that support teacher professional development can be exceptionally valuable to supporting teachers in under-resourced schools and in more isolated rural areas where access to the broader education community is more difficult. Cutting these programs becomes an equity issue when the teachers who are tasked with supporting the learning of students with the most challenges outside of school don’t have the tools they need to increase their own effectiveness.

• Educator Compensation: Along all the disinvestments already discussed, proposed changes to teacher retirement will weaken teachers’ total compensation, especially if teachers aren’t provided access to the social security safety net and if we don’t recognize the need for salaries and benefits competitive with the private sector. Not recognizing these issues will make it far harder for Kentucky to attract dedicated and talented people to the teaching profession.

While legislators are debating the next biennial budget, we are not making these decisions in isolation. Other states are increasing their investment from early childhood through postsecondary, recognizing human capital as the primary economic engine of their state and education as the primary input to quality of life. If Kentucky doesn’t deepen the investment in education, we will be at a severe competitive disadvantage for economic development in the near future.

It is for all of these reasons, Kentucky must commit to tax reform that grows with the changing economy, results in sustainable and structurally balanced budgets, and fulfills the promise of public education for every Kentuckian.

As a commonwealth, it behooves us to ensure that equity is not compromised, even for a moment, and that the assurance of an excellent education for each and every young person is regarded as the single greatest investment our Commonwealth can make.

Friday, March 30, 2018

Wednesday, March 28, 2018

Charter School Funding: First Estimates for HB 366

| Post by Susan Perkins Weston |

On March 20, the Senate amended House Bill 366 to add provisions for funding public charter schools. Here’s a look at what the bill would require and how that might work out financially.

Direct Revenue and On-Behalf Revenue

Under the bill’s current wording, school districts would transfer some funding, on a per-student basis, to the public charter schools they authorize (with some differences for charters authorized by mayors or in counties with four or more districts). That funding would depend on the number of students who attend the school and would include:

Also under those provisions, public charter schools would be eligible for state “on behalf” payments for some staff benefits. Those “on behalf” dollars are sent directly from the state to the benefit providers, and include contributions for:

Both types of funding would be based on the dollars available for students in regular public schools. The bill does not appropriate separate money or extra money. Instead, HB 366 calls for existing public education funding to be moved to different schools based on where students attend.

Some First Estimated Amounts

The House and Senate have approved two different versions of the state budget, and conference committee work is underway to reconcile the two. The House version has more generous funding for P-12 education overall, so separate estimates make sense for each chamber.

Under the House version of the budget, the charter rules in HB 366 might produce average funding per pupil about like this:

Under the Senate version, those same rules might produce average amounts like this:

Other Funding, Available And Not Available

Some public charters would also qualify for some further state dollars.that would be based on factors like whether they provide transportation, employ teachers with National Board Certification, enroll low-income students who take AP or IB Exams, are awarded grants that not all schools receive, or serve coal counties or counties that have recently suffered major losses in tax revenue from unmined minerals.

Public charter schools would not receive another form of local funding that goes to other schools. Under the SEEK formula, school districts have the option of raising dollars above the base and Tier 1 levels, but without any state equalization. Those local Tier 2 dollars would not have to be shared with public charter schools. The amount available from Tier 2 varies greatly from one district to another, but the recent average has been in the vicinity of:

More Information

More Information

Our PrichBlog two-pager shows how the calculations behind the numbers above and adds further detail on the further dollars that might be available under particular charter school circumstances. You’re welcome to download that to learn more, and the full text of the Senate version of HB 366 is available here, with the public charter school funding portion starting on page 94.

On March 20, the Senate amended House Bill 366 to add provisions for funding public charter schools. Here’s a look at what the bill would require and how that might work out financially.

Direct Revenue and On-Behalf Revenue

Under the bill’s current wording, school districts would transfer some funding, on a per-student basis, to the public charter schools they authorize (with some differences for charters authorized by mayors or in counties with four or more districts). That funding would depend on the number of students who attend the school and would include:

- State and local SEEK funding for the base guarantee per pupil and add-ons based on pupil needs (with transportation dollars handled a bit differently)

- State and local SEEK funding for Tier 1 optional equalized dollars

- State and federal categorical school funding

Also under those provisions, public charter schools would be eligible for state “on behalf” payments for some staff benefits. Those “on behalf” dollars are sent directly from the state to the benefit providers, and include contributions for:

- Health insurance for school employees

- Retirement for teachers

- Life insurance

Both types of funding would be based on the dollars available for students in regular public schools. The bill does not appropriate separate money or extra money. Instead, HB 366 calls for existing public education funding to be moved to different schools based on where students attend.

Some First Estimated Amounts

The House and Senate have approved two different versions of the state budget, and conference committee work is underway to reconcile the two. The House version has more generous funding for P-12 education overall, so separate estimates make sense for each chamber.

Under the House version of the budget, the charter rules in HB 366 might produce average funding per pupil about like this:

- $6,961 in direct revenue

- $1,706 in on-behalf revenue

- $8,667 in total revenue

Under the Senate version, those same rules might produce average amounts like this:

- $6,870 in direct revenue

- $1,584 in on-behalf revenue

- $8,454 in total revenue

Other Funding, Available And Not Available

Some public charters would also qualify for some further state dollars.that would be based on factors like whether they provide transportation, employ teachers with National Board Certification, enroll low-income students who take AP or IB Exams, are awarded grants that not all schools receive, or serve coal counties or counties that have recently suffered major losses in tax revenue from unmined minerals.

Public charter schools would not receive another form of local funding that goes to other schools. Under the SEEK formula, school districts have the option of raising dollars above the base and Tier 1 levels, but without any state equalization. Those local Tier 2 dollars would not have to be shared with public charter schools. The amount available from Tier 2 varies greatly from one district to another, but the recent average has been in the vicinity of:

- $1,789 in optional Tier 2 revenue raised entirely through local taxation

More Information

More InformationOur PrichBlog two-pager shows how the calculations behind the numbers above and adds further detail on the further dollars that might be available under particular charter school circumstances. You’re welcome to download that to learn more, and the full text of the Senate version of HB 366 is available here, with the public charter school funding portion starting on page 94.

Monday, March 26, 2018

Equity Supports Would Receive Extra Damage Under Senate Version of Budget

| Post By Susan Perkins Weston |

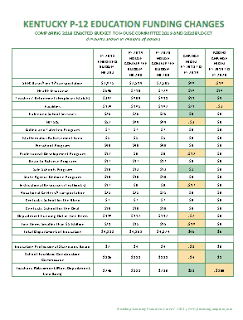

The version of the state budget approved by the House on March 20 includes major cuts likely to weaken Kentucky's efforts to develop the talents of all children and undo achievement gaps between groups of students. Key programs for supporting students with distinctive needs are slated for reduction or elimination, as are nearly all programs for equipping teachers to respond to those needs.

The $29 million in reductions to major student programs look like this:

This Senate version of the budget would do even greater harm than the House version. The House voted to eliminate textbook funding and cut FRYSCs (family resource and youth service centers), but it maintained fiscal 2018 funding for extended school services (tutoring), gifted and talented programs, preschool for children with disabilities or low family incomes, Read to Achieve grants to help students who struggle in reading catch up, or supports for children who have been placed in state agency care.

The $24 million in reductions to teacher development are the same ones PrichBlog has highlighted before, and they continue to pose a grave threat to teachers' ability to plan and implement the instructional innovations that will be needed to meet Kentucky's ambitious goals for raising achievement and reducing achievement gaps.

To repeat the major point about this approach, excellence with equity cannot be reached on this budget path.

The version of the state budget approved by the House on March 20 includes major cuts likely to weaken Kentucky's efforts to develop the talents of all children and undo achievement gaps between groups of students. Key programs for supporting students with distinctive needs are slated for reduction or elimination, as are nearly all programs for equipping teachers to respond to those needs.

The $29 million in reductions to major student programs look like this:

This Senate version of the budget would do even greater harm than the House version. The House voted to eliminate textbook funding and cut FRYSCs (family resource and youth service centers), but it maintained fiscal 2018 funding for extended school services (tutoring), gifted and talented programs, preschool for children with disabilities or low family incomes, Read to Achieve grants to help students who struggle in reading catch up, or supports for children who have been placed in state agency care.

The $24 million in reductions to teacher development are the same ones PrichBlog has highlighted before, and they continue to pose a grave threat to teachers' ability to plan and implement the instructional innovations that will be needed to meet Kentucky's ambitious goals for raising achievement and reducing achievement gaps.

To repeat the major point about this approach, excellence with equity cannot be reached on this budget path.

Wednesday, March 21, 2018

Senate proposed budget includes cuts to financial aid, postsecondary institutions

| Post by Perry Papka |

Under the budget bill passed by the Senate this week, state funding for postsecondary education will be cut over the next two years, with total decreases of 2% for financial aid resources and 3% for institutional funding. The proposal would continue the pattern of state disinvestment in Kentucky’s postsecondary institutions that has persisted since 2008, and since that time would total $224 million or 26%: a disinvestment whose costs are ultimately born by students and families.

Financial Aid

The proposed Senate budget would decrease state financial aid $12.1 million in FY 2019 and add back $8.2 million in FY 2020. Only 95% of net lottery revenue would go to financial aid, meaning $13.4 million would be shifted to other areas of government. Needs-based CAP and KTG would receive 45% of the net lottery proceeds, as compared to the 55% required by statute - but substantially more in dollars than the previous budget, approximately $30 million more over the two years.

Key steps include:

The proposed Senate budget would decrease overall state funding to public postsecondary institutions by $26.9 million in FY 2019 with no additional funding added in FY 2020. In FY 2019 $23.6 million and in FY 2020 $31.2 million would be allocated among institutions as performance-based funding based on their success at meeting goals. Both years would be less than the $42.9 million allocated to performance-based funding in FY 2018.

Compared to the FY 2018 budget, the Senate plan for FY 2019 would provide:

Want Further Detail?

We’ve created a PrichBlog summary with one page to show financial aid changes and a second to show the institutional budgets. You can download that here, or view the complete budget bill as approved by the Senate here.

Under the budget bill passed by the Senate this week, state funding for postsecondary education will be cut over the next two years, with total decreases of 2% for financial aid resources and 3% for institutional funding. The proposal would continue the pattern of state disinvestment in Kentucky’s postsecondary institutions that has persisted since 2008, and since that time would total $224 million or 26%: a disinvestment whose costs are ultimately born by students and families.

Financial Aid

The proposed Senate budget would decrease state financial aid $12.1 million in FY 2019 and add back $8.2 million in FY 2020. Only 95% of net lottery revenue would go to financial aid, meaning $13.4 million would be shifted to other areas of government. Needs-based CAP and KTG would receive 45% of the net lottery proceeds, as compared to the 55% required by statute - but substantially more in dollars than the previous budget, approximately $30 million more over the two years.

Key steps include:

- $10.6 million more for College Access Program (CAP) needs-based aid in FY 2019, with another $4.2 million added in FY 2020

- $5.1 million more for Kentucky Tuition Grant (KTG) needs-based aid in FY 2019, with another $1.8 million added in FY 2020

- $1.6 million more for Kentucky Educational Excellence Scholarships (KEES) merit-based funding increased in FY 2019, with another $2.3 million added in FY 2020

- Unchanged funding for National Guard Tuition Assistance, remaining at $7.4 million annually.

- $5 million less for Dual Credit scholarships in each year

- $13.4 million less for Work Ready scholarships in each year

- No funding for two previous lottery-funded programs: the Teacher Scholarship Program and Coal County College Completion Scholarships

- No funding for four non-lottery programs: Early Childhood, Work Study, Pharmacy, and Osteopathic Medicine

The proposed Senate budget would decrease overall state funding to public postsecondary institutions by $26.9 million in FY 2019 with no additional funding added in FY 2020. In FY 2019 $23.6 million and in FY 2020 $31.2 million would be allocated among institutions as performance-based funding based on their success at meeting goals. Both years would be less than the $42.9 million allocated to performance-based funding in FY 2018.

Compared to the FY 2018 budget, the Senate plan for FY 2019 would provide:

- $6.2 million less for University of Kentucky

- $4.8 million less for KCTCS

- $1.6 million less for University of Louisville

- $1.1 million less for Eastern

- $1.0 million less for Morehead

- $0.5 million less for Kentucky State

- $1.4 million more for Murray

- $1.5 million more for Western

- $4.7 million more for Northern

Want Further Detail?

We’ve created a PrichBlog summary with one page to show financial aid changes and a second to show the institutional budgets. You can download that here, or view the complete budget bill as approved by the Senate here.

Senate proposed budget includes alarming cuts to P12 education

| Post By Susan Perkins Weston |

Compared to the fiscal 2018 state budget currently in effect, the fiscal 2019 budget approved last night by the Senate would provide:

Within the Department of Education total reduction, the Senate-approved changes would include:

Elsewhere in the budget, the Senate would make a much larger cut with major implications for P-12 education. State budgets have long contained a separate appropriation to the Teachers Retirement System aimed at covering retirement benefits for work done in past years. That line item has historically included funding for health insurance for retirees who are not yet eligible for Medicare, costs of amortizing the accrued sick leave of new retirees, and contributions toward meeting the state’s unfunded pension liability. Compared to fiscal 2018, the Senate version of the fiscal 2019 budget calls for the state to provide:

Because retirement benefits are part of teachers’ total compensation, a cut of this scale would be likely to have a major impact on Kentucky’s ability to recruit and retain teachers in future years.

Matching past PrichBlog reporting, you can find more detail in this summary, including the Senate approach to fiscal 2020 and to smaller line item programs.

Compared to the fiscal 2018 state budget currently in effect, the fiscal 2019 budget approved last night by the Senate would provide:

- $92 million less for the Department of Education

- $6 million less for School Facilities Construction Commission

- $3 million less for Education Professional Standards Board

Within the Department of Education total reduction, the Senate-approved changes would include:

- $44 million less for school district employee’s health insurance

- $17 million less for instructional resources (textbooks)

- $13 million less for SEEK base/Tier 1/transportation

- $12 million less for teachers' retirement (employer match for current employees)

- $12 million less for professional development

- $6 million less for the preschool program

- $3 million less for FRYSCs

- $2 million less for extended school services

- $2 million less for Department funding not in line items

- $1 million less for the Read to Achieve program

- $1 million less for state agency children

- $13 million less for smaller line item programs funded for less than $5 million in fiscal 2018

- $1 million in new funding for AP and IB exam fees for students with low family incomes

- $8 million in new funding to offset local tax losses in districts that recently saw major reductions in the assessed value of their unmined minerals

- $3 million more for the safe schools program

- $21 million more for facilities

Elsewhere in the budget, the Senate would make a much larger cut with major implications for P-12 education. State budgets have long contained a separate appropriation to the Teachers Retirement System aimed at covering retirement benefits for work done in past years. That line item has historically included funding for health insurance for retirees who are not yet eligible for Medicare, costs of amortizing the accrued sick leave of new retirees, and contributions toward meeting the state’s unfunded pension liability. Compared to fiscal 2018, the Senate version of the fiscal 2019 budget calls for the state to provide:

- $492 million less for that teacher retirement line item

Because retirement benefits are part of teachers’ total compensation, a cut of this scale would be likely to have a major impact on Kentucky’s ability to recruit and retain teachers in future years.

Matching past PrichBlog reporting, you can find more detail in this summary, including the Senate approach to fiscal 2020 and to smaller line item programs.

Tuesday, March 13, 2018

Explaining SEEK: A New Short Publication

| Post by Susan Perkins Weston |

| Post by Susan Perkins Weston |Following up on a blog post from last fall, the Prichard Committee is now offering a brief “explainer” for the SEEK formula, designed for easy downloading, reading, and printing.

The report summarizes the four main steps of the SEEK funding process:

- The base guarantee gives all districts matching basic funding per pupil

- Add-on funding provides extra dollars based on identified student needs

- Tier 1 offers state equalization dollars to districts that set higher tax rates

- Tier 2 allows districts to raise further dollars without any state equalization

It also sets out some key concerns about the SEEK formula

- The base guarantee has not kept up with the cost of living

- The base guarantee relies more and more on local contributions

- Transportation add-on funding is far below the state’s own estimate of transportation costs

- Local Tier 2 revenue is an increasing (and increasingly unequal) part of total SEEK funding

Overall, this new tool is designed to inform Kentucky citizens on the central method our state uses to fund our schools. Please do check it out, and please do share any questions you may have.

Tuesday, March 6, 2018

House Cuts to Teacher Development Likely to Weaken Gap Reduction, Learning Growth

| Post By Susan Perkins Weston |

The budget bill approved last week by the Kentucky House of Representatives included funding for the Collaborative Center for Literacy Development (CCLD). Other than that one change, the House voted to follow Governor Bevin’s January budget proposal and eliminate nearly every teacher development program. That could do big damage to work statewide to build up Kentucky’s teachers and support the instructional innovations that will be needed to raise achievement for all students and reduce gaps for those who have long been underserved.

Under the Governor’s plan, the only teacher development funding was $5.4 million for the Mathematics Achievement Fund. Under the House plan, the only teacher development funding is that Fund plus $1.2 million for CCLD.

Here’s a table showing the development programs the House voted to eliminate:

One further note: the Kentucky Center for Mathematics has long been included in Northern Kentucky University funding, but without a separate dollar amount being shown in budget documents. As a result, I can’t quantify that cut, but I can report that House Bill 200 explicitly states that the Center is to receive no money from the general fund.

My January analysis of the Governor’s proposal now also applies to the House approach on teacher development:

The budget bill approved last week by the Kentucky House of Representatives included funding for the Collaborative Center for Literacy Development (CCLD). Other than that one change, the House voted to follow Governor Bevin’s January budget proposal and eliminate nearly every teacher development program. That could do big damage to work statewide to build up Kentucky’s teachers and support the instructional innovations that will be needed to raise achievement for all students and reduce gaps for those who have long been underserved.

Under the Governor’s plan, the only teacher development funding was $5.4 million for the Mathematics Achievement Fund. Under the House plan, the only teacher development funding is that Fund plus $1.2 million for CCLD.

Here’s a table showing the development programs the House voted to eliminate:

One further note: the Kentucky Center for Mathematics has long been included in Northern Kentucky University funding, but without a separate dollar amount being shown in budget documents. As a result, I can’t quantify that cut, but I can report that House Bill 200 explicitly states that the Center is to receive no money from the general fund.

My January analysis of the Governor’s proposal now also applies to the House approach on teacher development:

If teaching were rote labor, those cuts might not matter. If a diligent person could do the work just by following a list of instructions consistently, these reductions might be survivable. Teaching is the opposite. Teaching is supporting young minds, with varied gifts and diverse experiences, as they reach for understanding of a vast universe. Equipping the next generation requires constant study, relentless exploration, and unending creativity. Strong innovation in teaching and learning cannot be developed on zero dollars and sustained in brief moments grabbed in busy hallways.

If Kentucky agrees to strip teachers of learning funding and undermine their learning time, we will slow and maybe halt the learning changes Kentucky needs. The impact will be severe all around, but it will be hardest of all on students who most need upward movement in our schools, including students with identified learning disabilities, students who are learning English, students with low family incomes, and students of color.

Excellence with equity cannot be reached on this budget path.

Monday, March 5, 2018

House votes small increases to financial aid, postsecondary institutions

| Post by Perry Papka |

Under the budget bill passed by the House last week, state funding for higher education will increase modestly over the next two years, with growth both in financial aid resources and institutional funding.

Financial Aid

The proposed House budget would increase state financial aid $71,700 in FY 2019 and add a further $8.2 million for FY 2020. Key steps include:

Looking at individual institutions, the plan for FY 2019 would provide:

Want Further Detail?

We’ve created a PrichBlog summary with one page to show financial aid changes and a second to show the institutional budgets. You can download that here, or view the complete budget bill as approved by the House here.

Under the budget bill passed by the House last week, state funding for higher education will increase modestly over the next two years, with growth both in financial aid resources and institutional funding.

Financial Aid

The proposed House budget would increase state financial aid $71,700 in FY 2019 and add a further $8.2 million for FY 2020. Key steps include:

- $1 million more for Kentucky Educational Excellence Scholarships (KEES) merit-based funding increased in FY 2019, with another $2.3 million added for FY 2020

- $7.7 million more for College Access Program (CAP) needs-based aid in FY 2019, with another $4.2 million added for FY 2020.

- $2.5 million more for Kentucky Tuition Grant (KTG) needs-based aid in FY 2019, with another $1.8 million added for FY 2020.

- Unchanged funding for Work Ready scholarships, Dual Credit scholarships, and National Guard Tuition Assistance awards.

- No funding for two lottery-funded programs: the Teacher Scholarship Program and Coal County College Completion Scholarships

- No funding for four non-lottery programs: Early Childhood, Work Study, Pharmacy, and Osteopathic Medicine.

100% of net lottery revenue would go to financial aid, with needs-based CAP and KTG receiving only 43% of the total, as compared to the 55% required by statute.

Institutional Funding

The proposed House budget would also increase overall state funding to public postsecondary institutions by $11.3 million for 2019. For 2020, no additional funding would be added, and part of the total would be allocated among institutions as performance-based funding based on their success at meeting goals.Looking at individual institutions, the plan for FY 2019 would provide:

- $2.8 million less for KCTCS than the FY 2017 budget

- $0.3 million less for Morehead than FY 2017

- $0.1 million less for Eastern

- $1.2 million more for Kentucky State

- $2.6 million more for University of Louisville

- $2.6 million more for Western

- $3.9 million more for Northern

- $4.5 million more for Murray

- $7.3 million more for University of Kentucky

Want Further Detail?

We’ve created a PrichBlog summary with one page to show financial aid changes and a second to show the institutional budgets. You can download that here, or view the complete budget bill as approved by the House here.

Thursday, March 1, 2018

House votes to increase P-12 education funding

| Post by Susan Perkins Weston |

House Bill 200, Kentucky’s budget legislation for the next two fiscal years, is on the move. The House of Representatives just approved its version of the bill. Here’s a look at the major choices the House has made, along with a note that the Senate usually makes other changes and the two chambers negotiate to decide on a final spending plan.

Compared to the budget for fiscal 2018 (basically, the school year we’re in right now), the 2019 budget the House just voted on includes $45 million more in general fund support for the Department of Education. That includes funding increases of:

- $44 million for the SEEK formula, with an increase to the base guarantee per pupil and a decision not to make a major SEEK transportation cut that Governor Bevin had recommended.

- $21 million for school facilities

- $14 million for health insurance for teachers and other school and district employees

- $11 million for the employer share of contributions for current teachers’ retirement

- $3 million for the safe schools program

- $17 million from textbooks and other instructional resources

- $12 million from funding for educators’ professional development

- $3 million from family resource and youth service centers

- $2 million from overall Department of Education funding

- $14 million from a set of smaller programs that each had 2018 funding of less than $5 million

- Kentucky School for the Blind

- Kentucky School for the Deaf

- State operated vocational centers

- Extended school services

- Gifted and talented services

- Mathematics Achievement Fund

- Preschool

- Read to Achieve grants

- State agency children

Our new PrichBlog summary shows added detail, including changes for the 2020 budget and a detail page on small programs that receive less than $5 million in funding. You can download that here, or view the complete budget bill as approved by the House here.

Subscribe to:

Posts (Atom)